Essentials Un-usual

With the lockdown extension, there is a natural need for South Africans to feel secure about ongoing essential goods and services. BMi Research conducted a survey using an online panel from Borderless Access* to ascertain current perceptions on essential goods. 509 people were interviewed nationally from 12-13 April 2020.

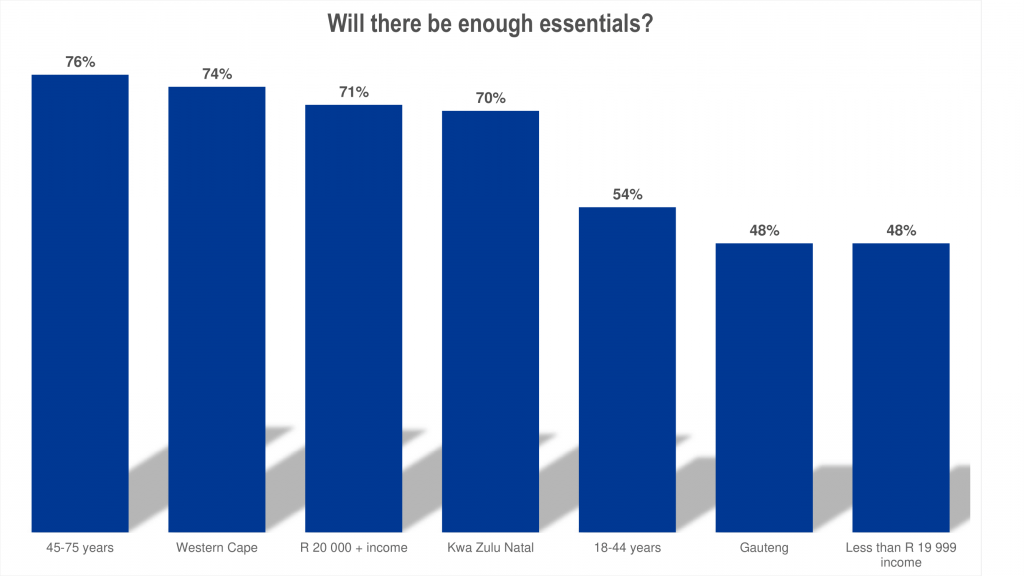

Almost two thirds (61%) think there will be enough essentials if the lockdown is extended even further. This is skewed to older, higher income, Western Cape and Kwa Zulu Natal respondents. Less than half of Gauteng and those who earn lower income believe there will be enough essential goods.

Almost two thirds (61%) think there will be enough essentials if the lockdown is extended even further. This is skewed to older, higher income, Western Cape and Kwa Zulu Natal respondents. Less than half of Gauteng and those who earn lower income believe there will be enough essential goods.

45% believe that cigarettes should be an essential good whilst only 32% believe that alcohol should be essential. Of the 68% who said that alcohol should not be an essential good, domestic safety in a lockdown environment was a concern: “Not having alcohol available, is the safest option. Alcohol inhibits a person’s mind. This is especially dangerous for people in abusive relationships” (Verbatim)

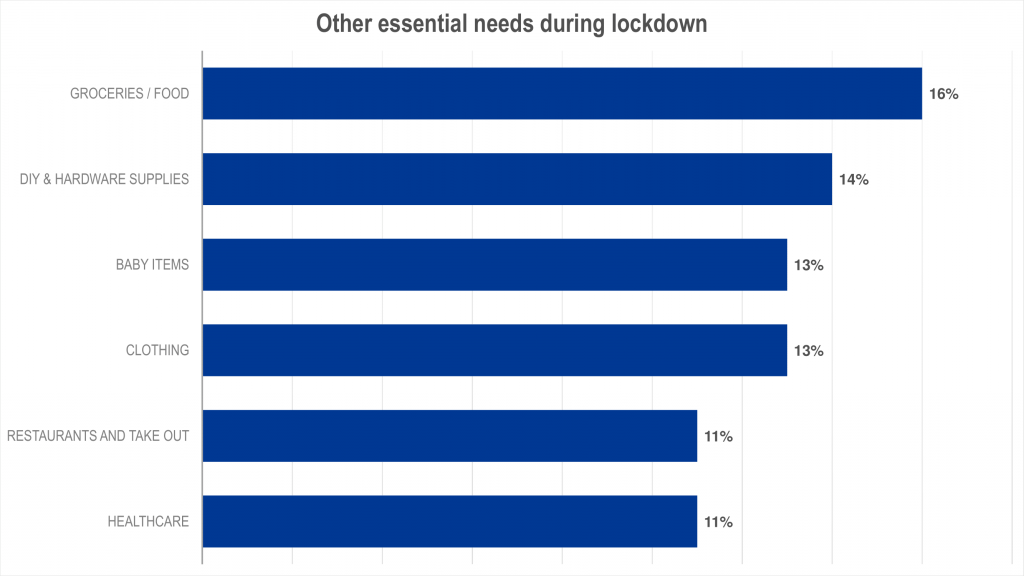

We asked South Africans what other essential goods and services should be available during the lockdown. Groceries is the most sited essential need (16%), followed by hardware supplies (14%). Respondents cited the need to use their lockdown time to fix and repair items in their homes. Clothing, baby items, healthcare and take away food are also noted to be essential goods during the lockdown.

With the need to stock up on essential goods, South African’s individual finance and debt situations are under a microscope.

Income security is low with only 24% of those surveyed believing they will have regular income during the lockdown and 34% think they will have regular income after the lockdown. An overwhelming 46% say they will have no income at all during the lockdown.

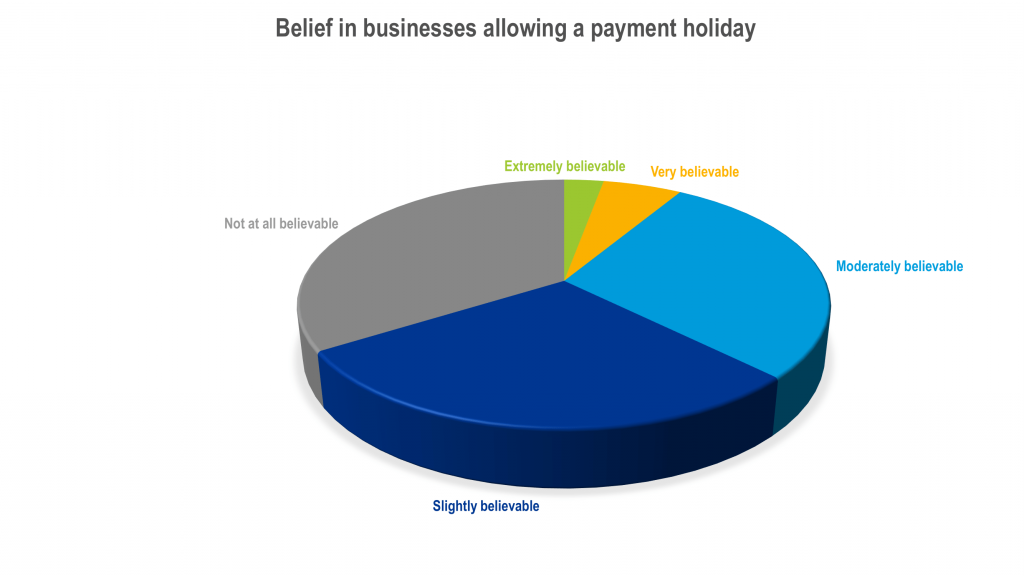

Of the 89% who have ongoing monthly payments beyond a mortgage, bank loan or credit card, only 9% find it very or extremely believable that they will receive a debt holiday during the Covid-19 crisis. 63% said a payment holiday is unbelievable or slightly believable.

Of the 89% who have ongoing monthly payments beyond a mortgage, bank loan or credit card, only 9% find it very or extremely believable that they will receive a debt holiday during the Covid-19 crisis. 63% said a payment holiday is unbelievable or slightly believable.

South Africans are thus faced with a two-fold financial burden, first of reduced income security and second of the need to have cash in order to stock on essential items to withstand the current lockdown and Covid-19 crisis. Contact us for ongoing data and insight solutions.

| Jenni-Ruth Coggin, key account manager at BMi Research

Contact:

Kevin Kruger: [email protected]

Jenni-Ruth Coggin: [email protected]

Cindi Collett: [email protected]

Danie Botha: [email protected]

Borderless Access is an award-winning digital MR product and solutions company. Driven by technology and consumer-analytics, it provides access to experiences and life moments of engaged consumers, to its global clientele of MR firms, Ad Agencies, Consultancy firms, and End Enterprises, with its 5.8M+ hyper-niche proprietary digital panels and innovative research solutions and platforms – TAPP, SmartSight, and HealthSight

Bev Tigar: [email protected]

www.borderlessaccess.com

*Of the 509 panel participants, 100% were South African and living in South Africa during the lockdown. 39% were in Gauteng, 23% in the Western Cape and 13% in Kwa Zulu Natal. 63% were female, 70% were aged 18-44 years old, 35% were Black and 50% were White. The sample was distributed equally across income groups.